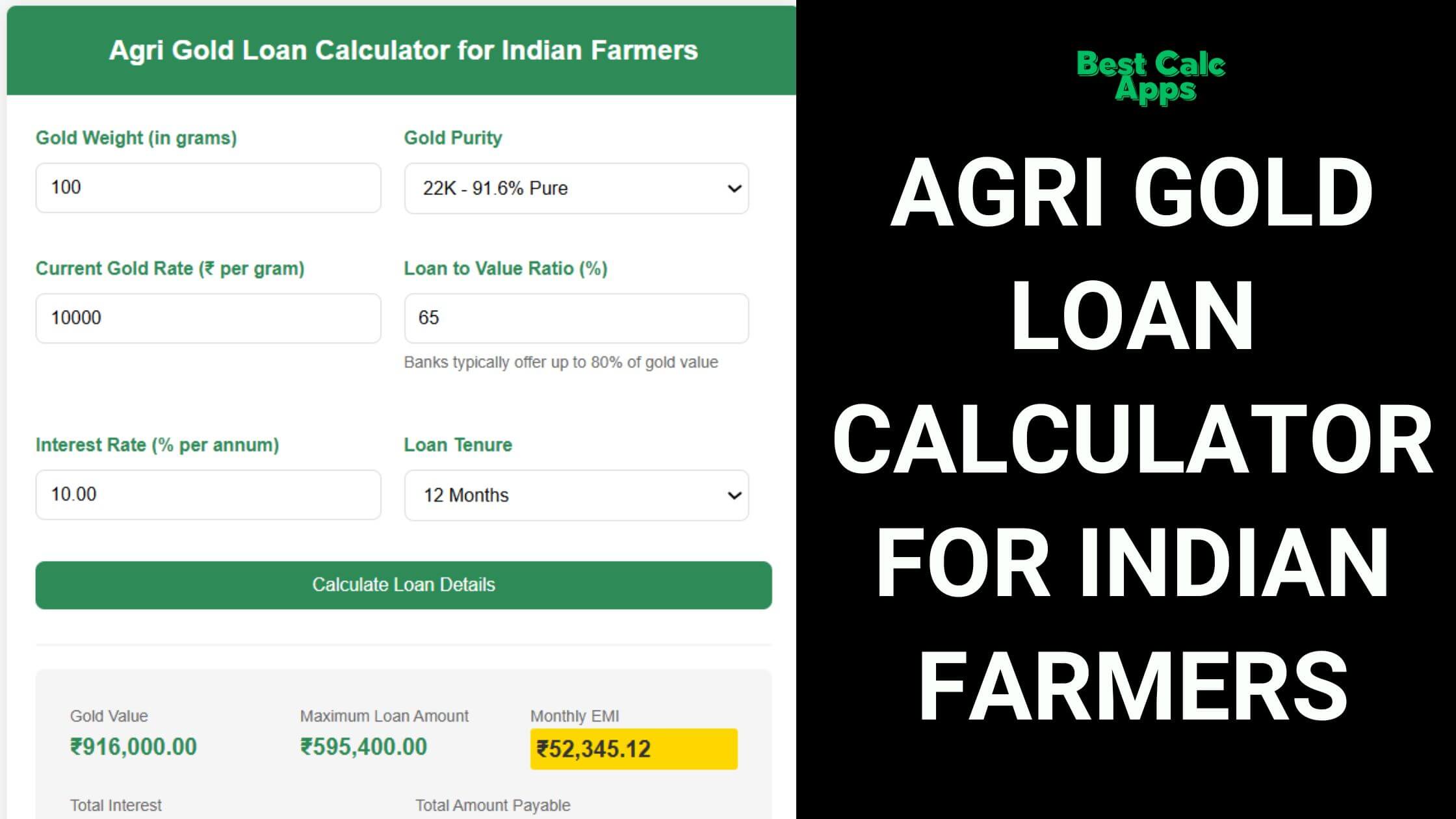

Agri Gold Loan Calculator for Indian Farmers

Banks typically offer up to 80% of gold value

Repayment Schedule

| Month | EMI | Principal | Interest | Balance |

|---|

Turning Family Gold into Farm Fortune: Your Guide to Smart Agricultural Financing

Have you ever looked at your family’s gold jewelry and wondered if it could do more than just sit in a safe?

For countless farming families across India, ancestral gold represents not just tradition, but untapped financial potential that could transform agricultural ventures.

That’s exactly why we’ve created our Agri Gold Loan Calculator for Indians, a game-changing tool that’s helping farmers nationwide convert precious metals into precious opportunities.

The Hidden Financial Power in Your Jewelry Box

Ramu Kaka from Sangli had been struggling with an aging irrigation system for three seasons. “The water barely reached half my fields,” he told me during a recent farmer gathering.

“Everyone said I needed a new system, but where would I find two lakh rupees before the monsoon?”

Like many farmers, Ramu had options he didn’t realize. Sitting in his steel almirah was his wife’s wedding jewelry—gold that could temporarily work harder for the family while remaining ultimately theirs.

This scenario plays out in millions of farming households.

Whether it’s upgrading equipment, investing in high-yielding seed varieties, or simply weathering a difficult season, Indian farmers face constant financial hurdles.

Traditional banking hasn’t always served their unique needs, leaving many caught in cycles of informal lending at crushing interest rates.

Breaking the Cycle: Why Agricultural Gold Loans Matter

“The moneylender in our village charges 3% monthly interest,” shares Lakshmi, a vegetable farmer from Kurnool district. “My father took such loans his entire life. I was following the same path until my cousin told me about agricultural gold loans at just 7.5% annual interest.”

This stark difference exists because banks like Bank of Baroda and IIFL have created specialized gold loan products specifically for agricultural purposes.

Unlike conventional loans with their maze of paperwork and credit checks, agricultural gold loans offer:

- Processing times measured in hours instead of weeks

- Minimal documentation requirements—perfect for rural communities

- Interest rates specifically designed for farming economics

- Repayment schedules that align with harvest cycles rather than calendar months

Yet despite these advantages, many farmers remain hesitant—not because they’re resistant to change, but because financial tools have historically seemed complex and unpredictable.

Your Financial Compass: How Our Calculator Transforms Decision-Making

Imagine standing at a crossroads with several paths before you, but no map to guide your journey. That’s what financial decisions feel like without proper tools.

Our Agri Gold Loan Calculator serves as that missing map—illuminating the path forward with clarity and confidence. Here’s how farmers across India are using it to reshape their agricultural futures:

Discovering True Borrowing Potential

Sunita from Punjab had always assumed her family’s 50 grams of gold wouldn’t amount to much financially.

After using our calculator, she discovered it could secure enough capital to install drip irrigation across her entire vegetable plot.

“I was shocked to see I qualified for nearly four lakh rupees against my jewelry,” she explains.

“The calculator showed exactly how the gold’s weight and purity translated to loan value—something no one had ever explained clearly.”

By entering just a few simple details about your gold—weight, purity, and current market rates—our calculator reveals your true financial potential, factoring in the special loan-to-value ratios banks offer specifically for agricultural purposes Understanding the Real Financial Picture

“No more surprises” is how Vijay, a sugarcane farmer from Maharashtra, describes his experience after using our calculator before approaching his bank.

Unlike vague promises from informal lenders, our calculator lays bare every aspect of your potential loan:

- The exact monthly payment amount you’ll need to budget for

- Precise breakdown of interest versus principal in each installment

- Total interest cost over the entire loan term

- Complete visualization of your decreasing balance over time

This transparency ensures you walk into financial decisions with open eyes—understanding exactly what you’re committing to and how it fits into your farm’s economic reality.

More Tools for Your Use:

Agricultural Loan Calculator for Ireland Farmers

Used Mobile Home Calculator for USA and UK Home Owners

Use our Snow Day Calculator Tool to Find Exact Snow Days

Tailoring Repayments to Farm Rhythms

Perhaps the most revolutionary aspect of our calculator is how it adapts to agricultural realities rather than forcing farmers to adapt to banking conventions.

When Mohan from Telangana used our calculator, he discovered he could structure his gold loan with quarterly payments that aligned perfectly with his cotton and pulse harvests.

“For the first time,” he says, “I found financing that understood my income doesn’t arrive monthly—it comes with my crops.”

The month-by-month repayment schedule generated by our calculator shows you exactly:

- When each payment is due

- How much goes toward interest versus principal

- How your remaining balance decreases over time

- How different payment structures affect your total interest cost

Making Informed Comparisons

Should you take a 12-month loan with slightly higher payments but lower total interest?

Or would a 24-month term with smaller installments better match your farm’s cash flow patterns?

Our calculator eliminates guesswork by letting you instantly compare different scenarios.

With just a few clicks, you can see exactly how changes in loan amount, tenure, or interest rate affect your financial commitment—a level of planning capability previously available only to large agribusinesses with financial advisors.

Designed by Farmers, for Farmers

What truly sets our calculator apart isn’t its mathematical precision—it’s how deeply it understands and respects agricultural realities.

Unlike generic loan calculators, ours recognizes that:

- Farm income arrives in seasonal waves, not steady monthly streams

- Agricultural investments often take months to generate returns

- Different crops create different cash flow patterns

- Weather uncertainties require financial flexibility

“It feels like it was designed by someone who actually understands farming,” notes Ramesh, a paddy farmer from West Bengal.

“Finally, a financial tool that speaks our language.”

Real Agricultural Applications, Real Results

The true measure of any tool is its ability to solve real-world problems. Here’s how farmers are putting our calculator to work:

Modernizing Farm Operations: Kartik from Gujarat used our calculator to plan financing for his first tractor.

“I could immediately see how different down payment amounts would affect my monthly obligations, and chose a structure that worked with my groundnut harvest schedule.”

Weather-Proofing Farms: When drought threatened her region, Sunita explored how much financing she could secure against family gold to install rainwater harvesting systems.

“The calculator showed me I could afford the entire system while keeping payments manageable.”

Expanding Growing Capacity: Brothers Raj and Prem used the calculator to determine exactly how much of their mother’s gold jewelry they’d need to pledge to double their greenhouse capacity.

“We could see precisely when we’d have the loan paid off and what our monthly commitments would be.”

Educational Investment: Many farming families use agricultural gold loans to fund children’s education during lean seasons.

Manoj and Priya discovered through our calculator that they could finance their daughter’s engineering program with affordable quarterly payments aligned with their major wheat harvests.

From Financial Confusion to Confidence

The most profound impact of our calculator isn’t just financial—it’s psychological. When farmers understand their options clearly, the entire power dynamic with lenders changes.

“I used to sit quietly while the bank officer told me what loan I could get,” explains Dharamvir, a mustard and wheat farmer from Haryana. “Now I walk in knowing exactly what my gold is worth, what terms I should receive, and how the repayment schedule should be structured. They treat me differently now—with respect.”

Your Agricultural Financial Journey Starts Here

In a farming landscape where access to timely capital often makes the difference between subsistence and prosperity, our Agri Gold Loan Calculator stands as a beacon of financial empowerment.

It transforms traditional family gold—something most rural households possess—into a dynamic agricultural asset that can be leveraged strategically when needed.

The calculator is completely free, requires no personal information, works on any device (from basic smartphones to computers), and gives instant results. We’ve designed it this way because we believe every farmer deserves access to clear financial information.

As the Federal Bank notes in their agricultural gold loan materials, farmers can access loans up to a maximum of INR 150 Lakhs against their jewelry at competitive rates.

Our calculator helps you determine exactly how much you qualify for and what repayment structure best suits your agricultural operation.

Your family’s gold has always been valuable—but now, with the right information at your fingertips, it can become truly transformative for your agricultural dreams.

Try our Agri Gold Loan Calculator today, and take the first step toward farming with financial confidence.

Understanding Your Agri Gold Loan Calculator: 5 Most Frequently Asked Questions

Are you considering using our Agri Gold Loan Calculator to plan your farm financing? You’re not alone! Here’s a friendly guide answering the questions most farmers ask about our calculator tool.

“How exactly does your calculator figure out how much loan I can get against my gold?”

When you’re looking to convert your family gold into farming capital, understanding the loan potential is crucial. Our calculator works its magic by considering three vital elements: how much your gold weighs, how pure it is, and what gold is selling for today.

First, we multiply these three factors to determine what your gold is worth in today’s market.

Then, we apply something called the Loan-to-Value (LTV) ratio—essentially how much of your gold’s value a bank is willing to lend. Most agricultural lenders offer between 60-80% of your gold’s value

What makes our calculator special is that you can adjust this percentage based on what your local bank or financial institution is offering farmers in your region.

Many institutions offer special LTV ratios for agricultural gold loans compared to regular gold loans, recognizing farmers’ unique needs .

“What kinds of gold can I use for an agricultural gold loan? Will my family jewelry work?”

Good news for farmers with traditional family gold! Most financial institutions accept gold ranging from 18K to 24K purity for agricultural purposes.

Our calculator includes all common purity options—24K (99.5% pure), 22K (91.6% pure), and 18K (75% pure).

Your typical family jewelry is usually 22K gold, which is widely accepted across India for agricultural gold loans.

Remember that purity significantly affects your loan amount—the higher the purity, the more financing you can secure.

This is particularly valuable when you need to make quick farming investments without lengthy paperwork “I’m trying to align loan repayments with my harvest cycle—how does your EMI calculation help with this?”

This is where our calculator truly shines for the farming community! Unlike general gold loan calculators, ours is designed with agricultural cycles in mind.

When you input your loan details, we use a specialized formula that calculates your Equated Monthly Installments (EMIs) based on the principal amount, interest rate, and tenure you choose.

But here’s the farmer-friendly part—we show you the complete repayment schedule month by month, allowing you to visualize how payments align with your expected harvest income farmers tell us they appreciate seeing exactly how much of each payment goes toward principal versus interest.

This helps plan around seasonal cash flow variations—a critical consideration that generic loan calculators simply don’t address!

“Can I use this tool to compare different loan scenarios based on my farming needs?”

Absolutely! Our calculator was designed specifically with farmers’ unique financial patterns in mind. You can easily adjust multiple variables to see how different scenarios would play out:

Try changing the loan tenure to align with your crop cycles—options range from 3 months for short-term crops to 36 months for long-term agricultural investments.

Switch between interest rates to compare offers from different institutions, which can start as low as 7.00% for agricultural gold loans. You can even adjust the loan percentage to see how different LTV ratios affect your borrowing power.

This flexibility allows you to create a repayment plan that works with your agricultural reality, whether that’s monthly payments, quarterly installments after smaller harvests, or larger semi-annual payments aligned with your major crop seasons “What makes an agricultural gold loan calculator better than a regular gold loan calculator for farmers like me?”

Great question! While a standard gold loan calculator gives basic numbers, our agricultural-focused calculator addresses the unique realities of farming finances.

For starters, we account for the specialized interest rates that banks offer specifically to farmers, which can be significantly lower than standard gold loan rates (starting from 7.00% compared to higher rates for regular gold loans).

These preferential rates exist because agricultural gold loans are designed specifically to support farming activities like equipment purchases, crop cultivation, and other agricultural needs calculator also recognizes the urgent nature of many farming expenses.

When you need quick capital for seeds before planting season or emergency funds for irrigation during a dry spell, the rapid processing nature of agricultural gold loans becomes crucial By helping you understand exactly how much you can borrow and at what cost, our calculator empowers you to make quick, informed decisions during critical farming periods.

Additionally, we’ve designed the repayment visualization to accommodate seasonal income patterns rather than assuming steady monthly income—a feature particularly appreciated by farmers whose income arrives in larger, less frequent amounts tied to harvest cycles.

In essence, this isn’t just a calculator—it’s a financial planning tool created specifically for the agricultural community, recognizing that farming finances follow different patterns than typical consumer loans.