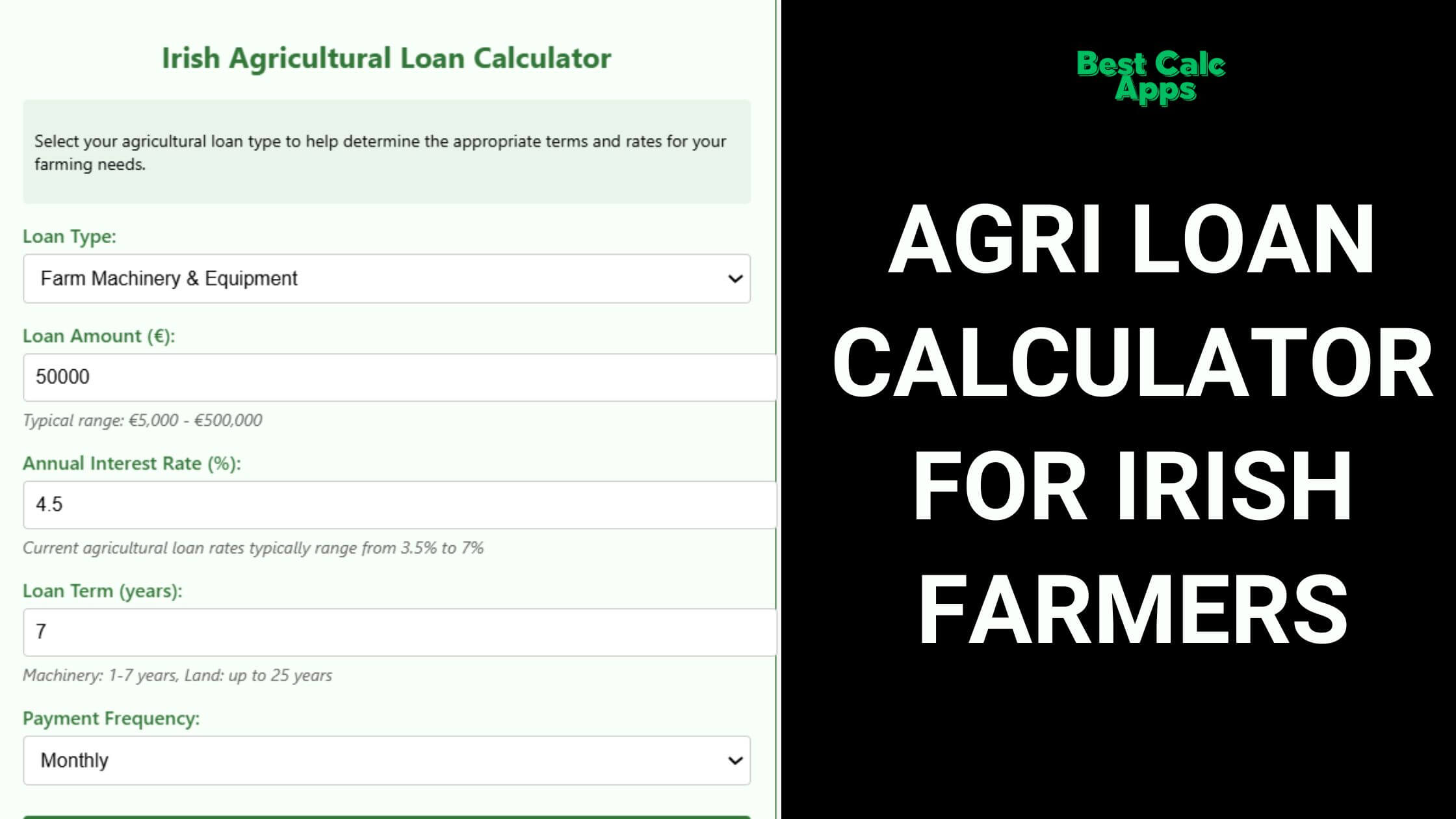

Irish Agricultural Loan Calculator

Select your agricultural loan type to help determine the appropriate terms and rates for your farming needs.

Loan Summary

Farm Finance Made Simple: The Irish Agricultural Loan Calculator That’s Changing How Farmers Plan Their Future

Rain tapping on the kitchen window, a cup of tea gone cold, and spreadsheets that make your head spin—this familiar scene plays out on farms across Ireland when it’s time to make those big financial decisions. Whether you’re eyeing that gleaming new tractor at the agricultural show or considering adding those twenty acres next door to your holding, the numbers matter. And frankly, they’ve never been easy to wrestle with—until now.

A Financial Companion Built for Irish Soil

I remember my father sitting at our oak kitchen table, pencil in hand, scratching figures onto the back of an envelope, trying to determine if we could afford new milking equipment. Today’s farming landscape demands more sophisticated tools, but most financial calculators might as well be designed for tech startups in Dublin rather than dairy farms in Tipperary.

That’s where our Irish Agricultural Loan Calculator steps in—not as another complex financial tool, but as a trusted companion who understands the rhythm of Irish farming.

“The first time I used it,” shares Seamus O’Neill, whose family has farmed in Wexford for three generations, “I was struck by how it seemed to know exactly what I was looking for. The suggested terms for my sheep barn extension weren’t some fantasy numbers—they reflected what I was actually seeing from agricultural lenders.”

Speaking Your Language: Farm Finance Without the Jargon

There’s something disheartening about tools that make you feel like you need a finance degree just to understand your own farm’s future. We’ve taken a different route.

When you select “livestock purchase” on our calculator, you won’t just get generic loan information. Instead, you’ll see terms that reflect the reality of Irish cattle or sheep investment—typically shorter loan durations around 3 years with interest rates that mirror what actual Irish agricultural credit unions and banks are offering right now.

This isn’t just convenient—it’s transformative for your planning process.

Think about Máire from Galway, who was considering expanding her suckler herd. “Before using this calculator, I was guessing at what my repayments might look like. The bank gave me figures, but I couldn’t play around with different scenarios on my own time. Having this tool let me see what would happen if I extended the term by two years or made quarterly payments instead of monthly ones. I walked into my next bank meeting with confidence I never had before.”

More Calculators for You to Use:

Calculate Your In-Hand Salary with Our Free Calculator

Calculate Crypto Trading Profit with our Free Calculator

Check out XRP Investment Calculator for US Investors

Crystal Clear Numbers When They Matter Most

Irish farming has always operated on fine margins. When global milk prices drop or grain values fluctuate, the difference between a sustainable operation and financial strain often comes down to how well you’ve structured your farm’s debt.

Our calculator shines in four areas that matter deeply to every farmer:

Genuine Payment Predictions

No more approximations or rounded figures. The calculator shows precisely what you’ll pay at every installment, whether you prefer aligning payments with milk cheques, harvest income, or regular monthly budgeting.

As Martin from Cork puts it, “I finally could see exactly how matching my repayment schedule to my seasonal income would affect the total cost. Turns out, quarterly payments aligned with my dairy operation saved me nearly €2,000 over the life of my equipment loan.”

The Full Picture of Your Commitment

Beyond the regular payment amount, you’ll see the complete journey of your loan—total interest paid over its lifetime and the full repayment amount. This transparency helps you evaluate whether that new grain storage facility will truly deliver returns that justify its cost.

Flexibility That Follows Your Farm’s Natural Cycle

Irish farming doesn’t follow neat monthly patterns. Spring brings calving and planting, autumn brings harvest, and income often arrives in seasonal waves. Our calculator lets you explore payment options that mirror your farm’s natural rhythm—whether that means heavier payments after harvest or lighter obligations during investment-heavy spring months.

True Cost Understanding

The difference between the advertised interest rate and what you’ll actually pay can be substantial. Our calculator reveals the effective annual rate, accounting for how often interest compounds based on your payment schedule. This insight has helped countless farmers negotiate better terms with their lenders.

Real Farm Scenarios, Real Solutions

Let’s walk through how farmers across Ireland are using this calculator to make smarter decisions:

The Dairy Expansion Dilemma

Take Dermot from Kilkenny, who needed to decide whether expanding his milking parlor was financially viable after milk quotas ended. By testing various scenarios in the calculator, he discovered that a 7-year equipment loan with quarterly payments best matched his milk income pattern, keeping payments manageable while minimizing total interest.

“I was leaning toward the standard 5-year term the bank first offered,” Dermot explains, “but seeing the numbers laid out showed me that stretching to 7 years reduced pressure on cash flow during the critical first years after expansion. The calculator showed me exactly how much extra interest that decision would cost—a trade-off I was comfortable making for better sleep at night.”

The Multi-Generation Land Purchase

For the O’Rourke family in Westmeath, adding neighboring land to their tillage operation represented a once-in-a-generation opportunity. Using the calculator, three generations sat together at the kitchen table exploring how different down payments, terms, and payment schedules would impact both immediate farm viability and long-term financial health.

“We modeled everything from a 15-year aggressive paydown to a 25-year more conservative approach,” shares the youngest O’Rourke. “Being able to see the total interest difference between those scenarios—nearly €78,000—helped us have an honest family conversation about balancing current farming needs with the legacy we’re building.”

The Calculator That Grows With Your Farm

What truly sets this tool apart is how it evolves alongside your planning process:

Intuitive by Design: You won’t need to dig out the instruction manual—the calculator guides you naturally through each step, using farming terminology that feels familiar rather than financial jargon that creates distance.

Field-Ready Access: Make calculations wherever farming takes you—checking figures while walking potential new grazing land, sitting in the tractor cab during a rain delay, or preparing for a meeting with your agricultural advisor.

Works Without Waiting: Anyone who’s dealt with spotty rural broadband understands the frustration of online tools that buffer endlessly. Our calculator works entirely within your browser—no waiting, no data charges, no connectivity headaches.

Turning Numbers Into Farming Wisdom

This calculator isn’t just about mathematics—it’s about transformation. When you can clearly visualize different financial pathways before committing to them, you gain something precious: confidence.

“There’s something powerful about seeing the numbers plainly laid out,” notes Patricia, a sheep farmer from Donegal. “It takes these big, sometimes frightening financial decisions and breaks them down into something tangible I can wrap my head around. I’ve used the calculator for everything from fencing loans to a new quad bike.”

Dr. Liam Kennedy, who advises farm families on succession planning, puts it this way: “Financial clarity is often the missing ingredient in farm planning. When farmers can independently model different scenarios and truly understand their implications, they make decisions aligned with both their immediate needs and long-term vision for the land.”

Making the Calculator Work for Your Farm

To extract maximum value from this tool, consider these farmer-tested approaches:

- Before any purchase, run three scenarios: Your ideal case, a compromise option, and a “what if things get tight” version. Understanding these boundaries helps you negotiate with confidence.

- Use it before refinancing existing loans: Many farmers have discovered substantial savings by modeling how consolidating or restructuring current farm debt would affect their monthly obligations.

- Make it a family affair: Some of the best financial decisions emerge when multiple generations explore options together, balancing different perspectives and priorities.

- Bring the results to your farm advisor: Starting consultations with clear figures in hand transforms these conversations from general guidance to specific strategic planning.

Your Farm’s Financial Future—Clearer Than Ever

In the unpredictable world of Irish agriculture, where weather, markets, and policies seem to shift like our famous western winds, having solid financial ground beneath your feet matters more than ever.

Our Irish Agricultural Loan Calculator puts sophisticated financial analysis into practical, farmer-friendly form—no finance degree required, no complicated software to install, just straightforward answers to your most important questions.

Whether you’re considering your first substantial farm investment or planning the next chapter of a generations-old family enterprise, this tool offers something invaluable: clarity when it matters most.

So the next time you’re contemplating that equipment upgrade, land purchase, or building project, remember—better decisions begin with better information. Your farm deserves nothing less.

Try the calculator today. Your future self—and perhaps future generations of your family—will thank you for it.