In-Hand Salary Calculator (India)

* For estimation only. Actual salary may vary.

Decode Your Paycheck: Introducing the Free In-Hand Salary Calculator on BestCalcApps.Com! (India Estimate)

That moment arrives. You’ve received a job offer, or perhaps you’re reviewing your current compensation structure. The number that often stands out is the CTC – Cost To Company – or the Gross Annual Salary. It looks impressive on paper! But then comes the first payslip, and the amount credited to your bank account, the actual in-hand salary, seems significantly different. Why the gap? What happened to that larger figure?

This confusion between Gross Salary and Net Salary (or Take-Home Pay) is incredibly common across India, from fresh graduates stepping into their first job in bustling cities like Mumbai or Pune, to experienced professionals here in Nashik and beyond. Understanding this difference isn’t just about satisfying curiosity; it’s crucial for effective budgeting, financial planning, comparing job offers accurately, and achieving overall financial well-being.

Navigating the maze of deductions – Provident Fund, Professional Tax, Income Tax, and potentially others – can feel overwhelming. Payslips themselves can sometimes look like complex code sheets. Wouldn’t it be great if you had a simple tool to get a quick estimate of your monthly take-home pay, cutting through some of the initial complexity?

Well, good news! We at BestCalcApps.com are thrilled to introduce our brand new, easy-to-use In-Hand Salary Calculator – designed specifically as a handy estimation tool for salaried individuals in India.

Why the Big Difference? Gross Salary vs. Net In-Hand Salary

Before diving into our calculator, let’s quickly clarify these essential terms:

- Gross Salary: This is your total salary before any deductions are made. It typically includes your Basic Salary, House Rent Allowance (HRA), Dearness Allowance (DA, if applicable), and other allowances like transport, medical, or special allowances, as defined in your employment contract or company structure. It’s the figure often discussed during salary negotiations alongside the CTC.

- Net Salary (In-Hand Salary / Take-Home Pay): This is the actual amount that gets credited to your bank account after all mandatory and voluntary deductions have been subtracted from your Gross Salary. This is the money you have available for your monthly expenses, savings, and investments.

- Deductions: These are the amounts subtracted from your Gross Salary. They fall into several categories:

- Statutory Deductions: These are mandated by law, such as Employee Provident Fund (EPF) and Professional Tax (PT). Income Tax (TDS – Tax Deducted at Source) is also a major statutory deduction.

- Voluntary Deductions: These might include contributions to things like the National Pension System (NPS), health insurance premiums (if not fully covered by the employer), or repayments for company loans.

Understanding these components is the first step towards financial clarity. Our calculator focuses on providing an estimate by considering some of the most common statutory deductions.

What Our In-Hand Salary Calculator Does (And How It Helps You)

Our new calculator, available right here on BestCalcApps.com, is designed for simplicity and speed. Its primary goal is to give you a reasonable estimate of your monthly take-home pay based on your Gross Annual Salary, factoring in two common deductions:

- Employee Provident Fund (EPF): A government-mandated retirement savings scheme. Typically, both the employee and employer contribute. The employee’s contribution (which reduces your in-hand salary) is usually 12% of your Basic Salary (+ Dearness Allowance, if any).

- Our Calculator’s Assumption: Since the exact Basic Salary component can vary greatly (often 40-60% of Gross), our calculator makes a common assumption: it estimates your Basic Salary as 50% of your Gross Monthly Salary for the EPF calculation. It also respects the statutory wage ceiling for mandatory contributions, capping the employee’s PF deduction at ₹1,800 per month (12% of ₹15,000) if the calculated Basic exceeds this threshold.

- Professional Tax (PT): A tax levied by state governments on salaried individuals and professionals. The rates and slabs vary significantly from state to state.

- Our Calculator’s Assumption: Given our context here in Nashik, Maharashtra, the calculator uses a simplified Maharashtra PT rule: It deducts ₹200 per month if your calculated Gross Monthly Salary is above ₹10,000. Below this threshold, it assumes nil PT for this estimate. (Note: Actual Maharashtra PT has minor variations, like ₹300 in February, but ₹200/month is the standard deduction for most months in the common salary brackets).

Key Benefits of Using Our Calculator:

- Instant Estimates: Get a quick idea of your potential monthly take-home pay in seconds.

- Ease of Use: No complicated forms. Just enter your Gross Annual Salary.

- Demystifies Basic Deductions: See estimated figures for EPF and PT, helping you understand where some of the money goes.

- Useful for Comparisons: Quickly compare the potential take-home pay from different job offers (keeping limitations in mind).

- Budgeting Aid: Provides a starting point for creating your monthly budget based on estimated income.

- Completely Free: Accessible to everyone visiting BestCalcApps.com.

Crucial Point: What Our Calculator Doesn’t Include (Managing Expectations)

It’s vital to understand that this tool provides an ESTIMATE. It is not a substitute for an official payslip or professional financial advice. The biggest factor it does not calculate is Income Tax (TDS).

Why exclude Income Tax? Because calculating it accurately requires much more information than just your Gross Salary. It depends on:

- Your Chosen Tax Regime: Are you under the Old Regime (with deductions like 80C, 80D, HRA exemptions) or the simpler New Regime (lower slabs, fewer exemptions)?

- Your Investments & Deductions: How much are you investing in tax-saving instruments (like PPF, ELSS, insurance under Section 80C)? Do you have home loan interest (Section 24b)? Are you claiming HRA exemption based on your actual rent paid?

- Your Age: Tax slabs differ for senior citizens.

- Other Income Sources: Your total tax liability depends on all income sources.

Including all these variables would make the calculator far too complex for its intended purpose of providing a quick estimate.

Furthermore, the calculator also doesn’t account for:

- Company-specific deductions (e.g., health insurance premiums, transport facility fees, loan EMIs).

- Allowances with specific tax treatments (like HRA exemption calculations).

- Bonuses, performance pay, or Leave Travel Allowance (LTA), which are often taxed differently or paid out separately.

- Variations in the Basic Salary component (our 50% assumption might not match your company’s structure).

Therefore, please use this calculator as a preliminary guide, not as a definitive statement of your final in-hand salary. Your actual payslip will reflect the precise calculations based on your specific circumstances and company policies.

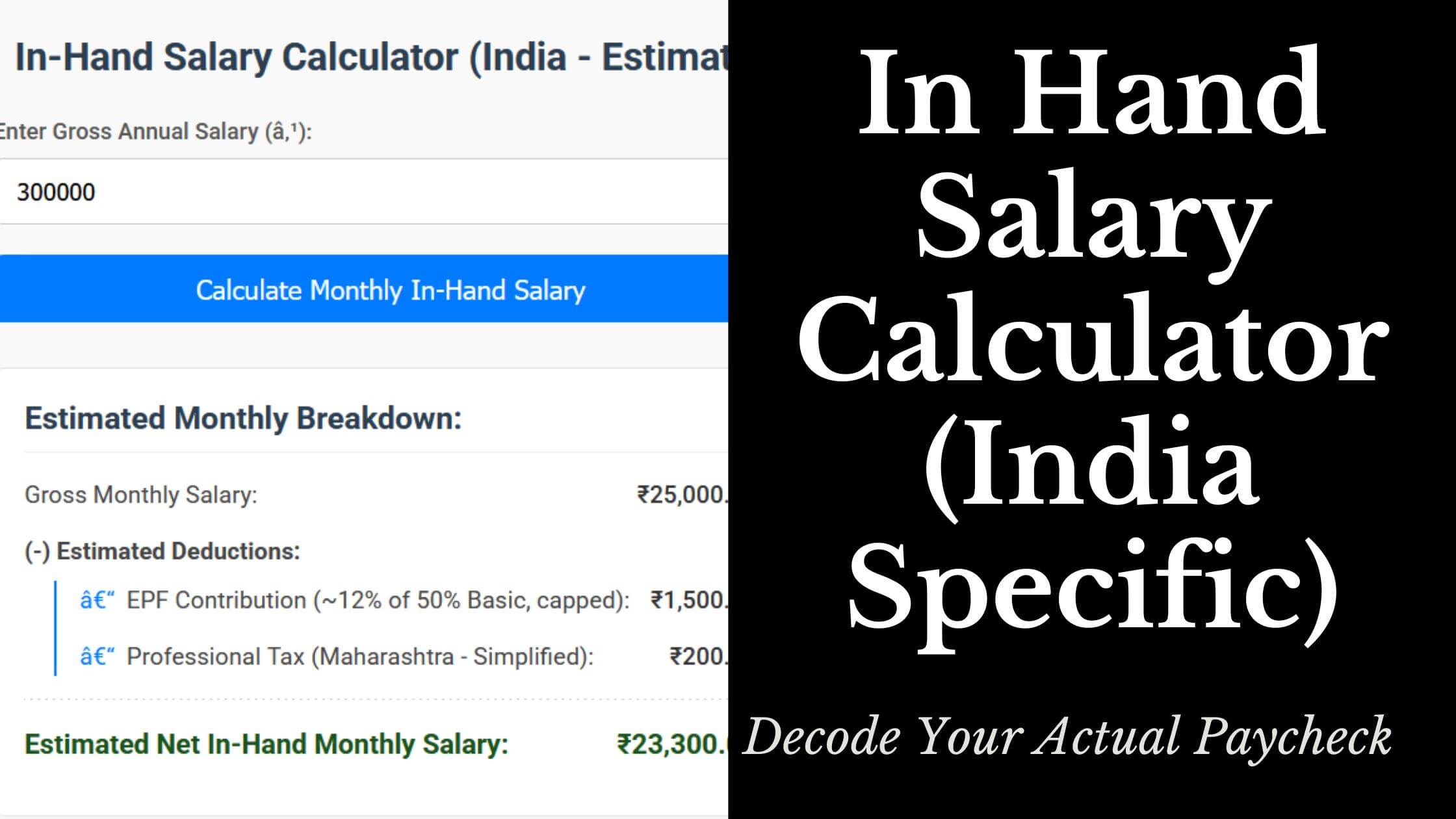

How to Use the BestCalcApps.com‘s In-Hand Salary Calculator

Using the calculator couldn’t be simpler:

- Navigate: Find the calculator tool on this page: (Bookmark it for future use!)

- Input: Locate the field labelled “Enter Gross Annual Salary (₹)”. Type in your total gross salary for the year (e.g., if your annual package is ₹8,00,000, enter 800000).

- Calculate: Click the “Calculate Monthly In-Hand Salary” button.

- View Results: Instantly, the calculator will display:

- Your estimated Gross Monthly Salary.

- The estimated monthly deduction for EPF (based on the 50% Basic assumption).

- The estimated monthly deduction for Professional Tax (based on simplified Maharashtra rules).

- Your Estimated Net In-Hand Monthly Salary.

The results are clearly formatted, making it easy to see the breakdown.

Why Understanding Your In-Hand Salary Matters

Knowing your approximate take-home pay is the cornerstone of sound financial management. It allows you to:

- Budget Realistically: Plan your monthly spending based on the money you actually receive.

- Set Savings Goals: Determine how much you can realistically save or invest each month.

- Evaluate Job Offers: Compare offers not just on CTC, but on potential take-home pay (using this calculator as a first step).

- Plan Loan Repayments: Understand your repayment capacity for EMIs.

- Gain Financial Confidence: Removing the ambiguity around your salary empowers you to make better financial decisions.

Take Control: Try the Calculator Now!

Stop guessing and get a clearer picture of your potential monthly earnings. Whether you’re negotiating a new role, planning your finances for the upcoming year (we’re already nearing the end of the first quarter of 2025!), or just curious, our calculator is here to help.

It’s fast, free, and designed with the common Indian salary structure in mind (acknowledging its simplifications).

Ready to decode your salary?

>> Click here to use the In-Hand Salary Calculator Now! <<

We hope you find this tool valuable. Share it with friends or colleagues who might also benefit from a quick salary estimate! At BestCalcApps.com, we aim to provide useful resources, and this calculator is just one step in empowering our readers with practical financial insights.

Disclaimer: The In-Hand Salary Calculator on BestCalcApps.com provides estimates based on simplified assumptions (50% Basic for EPF calculation capped at ₹1800/month, ₹200/month PT in Maharashtra for Gross Monthly > ₹10,000). It explicitly excludes Income Tax (TDS) and other potential deductions or variable pay components. The results should be used for informational purposes only and do not represent your exact final take-home salary. Always refer to your official payslip and consult with a financial advisor for precise calculations and financial planning.